Want Your Parents and Grandparents in Canada? Here is What to Do

By Canadian LIC, October 2, 2023, 8 Minutes

- Want Your Parents and Grandparents in Canada?

- Super Visa Insurance

- Difference between Parent Super Visa Insurance and Visitor Visa

- Super Visa Insurance Eligibility Criteria

- Writing a letter of invitation for a Super Visa

- Process of Applying for a Canadian Super Visa Insurance

- Can one apply for Super Visa Insurance from a visa-exempt country?

- The processing fee for a parent or grandparent Super Visa.

- Parent Super Visa Insurance processing time

- Can one work in Canada with a Super Visa?

- Is it allowed to stay permanently in Canada with a Super Visa?

Canada is an attractive place for all those looking for a high-quality life as it offers world world-class education and a flourishing job market. It is an exceptionally beautiful country with a multicultural population. The good news is that the government of Canada always welcomes millions of immigrants with open arms. So if you are new to Canada and have been missing your family and want to invite them over for long periods, then Canadian Super Visa Insurance might be your perfect solution.

In this article, you will learn everything about Canadian Super Visa.

If you are new to Canada, inviting your parents or grandparents wouldn’t be that easy for you. In the case of foreign national parents, there is a need for a visitor visa to be in Canada, whose time limitations are not enough to fulfill your needs. Hence, the Canadian government’s Super Visa program solves all your problems.

Super Visa Insurance

A Super Visa is an answer to the problems of foreign nationals who want to call their parents or grandparents to Canada to live with them. The Parent Super Visa Insurance allows parents and grandparents to visit Canada for 5 years without needing renewal.

On a Super Visa, the legal status of your parents or grandparents coming to meet you will be that of a visitor. They will not have those legal rights and responsibilities that you have as a permanent resident, like working in Canada.

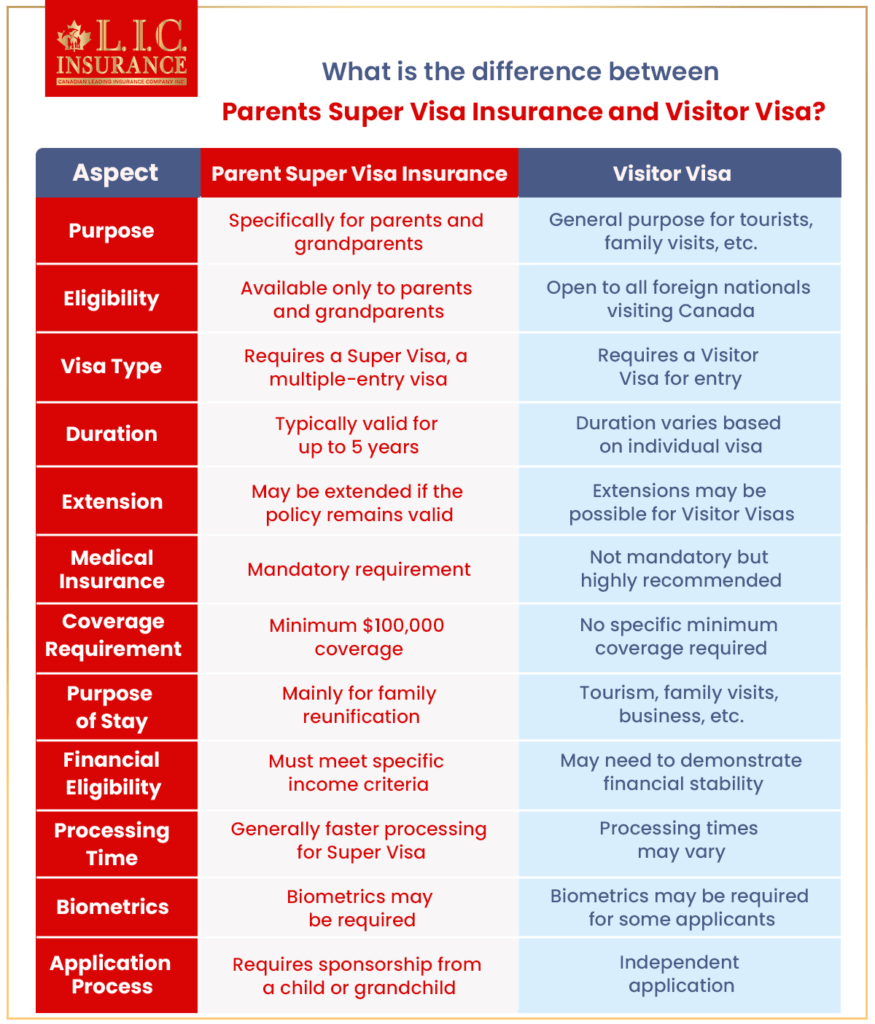

Difference between Parent Super Visa Insurance and Visitor Visa

Parents Super Visa Insurance and Visitor Visa

Both visas grant a visitor status but still have a few differences. Let’s find them out.

- The duration of stay: A super visa is for five years; on the other hand, a visitor visa is for just six months.

- Validity: A super visa has 10 years of validity or until the expiry of your passport. On the other side, the visitor visa validity is shorter.

- Eligibility: Anyone can apply for a visitor visa to Canada, whereas only parents or grandparents of Canadian citizens or permanent residents can apply for a Parent Super Visa Insurance.

- Type of entry: Parents and grandparents can have multiple entries into Canada through a Super Visa Insurance. This means that the visa holder can exit and re-enter the country as often as required. On the other side, a visitor visa can be a single or multiple entry, the decision of which lies in the hands of the visa officer.

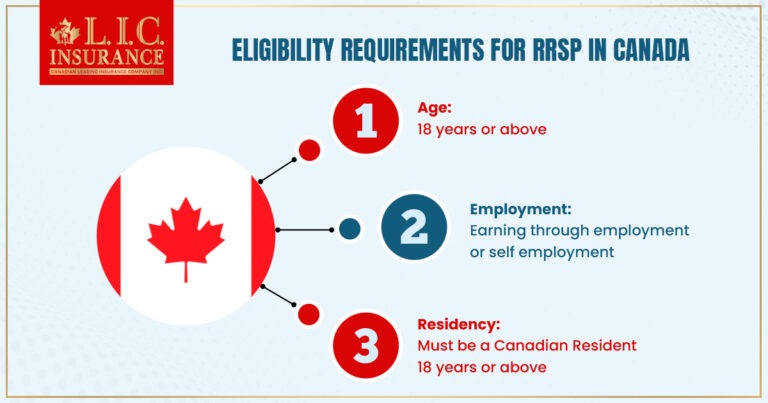

Super Visa Insurance Eligibility Criteria

Whoever applies for the Super Visa must:

- Have a child or grandchild as a permanent resident or citizen of Canada.

- Applying from outside Canada.

- Possesses medical insurance of at least $100,000 CAD with at least a one-year validity from an insurance provider in Canada.

- Possess a signed invitation letter from the child or grandchild they will meet in Canada.

- Fulfill other permissible requirements like clearing a medical exam. Some other factors like the purpose of the visit, the economic and political stability of the applicant’s home country, and more might also be looked into by the Canadian government while reviewing the applications for a Super Visa.

Writing a letter of invitation for a Super Visa

Suppose you’re inviting your parents or grandparents to stay with you in Canada for an extended period. In that case, they will require your written invitation letter for their super visa application.

This invitation letter has a written commitment that you’ll be taking all the financial responsibility for the parent or grandparent you invite for their stay in Canada. It must have the following below-mentioned information:

About the ones visiting:

- Their full name and birth date.

- Their home countries’ addresses and telephone numbers.

- What is their relationship with you?

- Their trip’s purpose and the duration they plan to stay in Canada (Include dates).

- The place they will stay and the way they will pay for their expenses.

About the invitee(i.e you):

- Your full name, along with your date of birth.

- Your complete address and Canada phone number.

- Your legal status and a copy of your PR card, Canadian citizenship card, or Canadian birth certificate.

- Your job.

- Number of people in your household, including your family and any other people you’ve sponsored.

- Family details, along with names and dates of birth of your spouse, children, and other dependents, if any.

- Your income proof should equal or exceed the low-income cut-off (LICO) for the total number of people present in your family, along with the parent or grandparent being invited.

- A signed commitment to financially support your parent/grandparent for their duration of stay in Canada.

Process of Applying for a Canadian Super Visa Insurance

Super Visa applications are accepted all throughout the year. So if all the document proofs required have been submitted to provide evidence of the eligibility of both the invitee and the one visiting, then most likely, the application will get approved.

Now let’s go through the application process step by step.

Step 1: Decide between an online or paper application.

Firstly, the Parent Super Visa Insurance applicant must be outside of Canada. Online applications are a better option as it helps eliminate courier charges and processing delays. They can submit their application online or on paper; however, online applications are recommended. You can also track the status of your application if you go through the online process.

Step 2: Collect all essential documents.

Tell your parents or grandparents to collect all the essential documents after going through the document checklist. These documents include the following:

- Passports

- Birth and Marriage Certificates

- Travel dates

- Medical Insurance Proof

- Their letter of invitation, along with your status proof in Canada and financial documents.

- Copies of your parents and grandparents’ financial documents will also be needed (like their tax returns, property documents, bank statements, investments, and more.)

Step 3: Fill out and apply.

Fill in the super visa insurance application after gathering all the necessary documents. Before applying, make sure that the processing and biometrics fees must be paid online using a debit or credit card. Please keep a copy of the receipt for paper applications, as it must be submitted along with the filled-out application. If biometrics is needed for your country, then in that case, paper applications must be submitted at the local visa application center in person.

Step 4: Submit additional documents as needed.

Your parents’ or grandparents’ can also be asked for some additional documents as per the country they are applying from. There can be a requirement for them to submit their biometrics (like fingerprints and photographs), provide a police certificate and appear for a medical exam. The applicants can also be interviewed at their local visa office.

Step 5: Take your Super Visa and get ready to travel.

Finally, your parents/grandparents must submit their passports and get their visas once their super visa insurance applications have been processed and approved. There will be an expiry date present, and your parents/grandparents will now be able to travel to Canada as many times as they wish throughout the validity of the super visa.

They will only be required to show their passport, visa, and medical insurance to the border officer while travelling.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Can one apply for Super Visa Insurance from a visa-exempt country?

This can be done in the case of individuals who want to stay in Canada for more than six months at a time. The application process is a bit different for visa-exempt travellers. They don’t receive visa stickers on their passport; instead, they get an approval letter to present to the border officer when they arrive.

The processing fee for a parent or grandparent Super Visa.

A parent or grandparent super visa insurance cost is about $100 CAD. The applicants might also be required to pay additionally around $85 CAD for biometric processing. Then they might also have to pay between around $200 CAD and $300 CAD for a medical exam if there is a need for one. All these super visa insurance costs exclude travel costs, compulsory health insurance, courier charges, or the amount that will be spent during their stay in Canada.

Parent Super Visa Insurance processing time

The Super Visa Insurance processing time is different in the case of different countries while applying from India takes around 135 days.

Other factors also affect the processing time for your application, like the number of applications the government receives, the status of your application, and the time taken to verify the information you provided.

Stay updated with the government website for the processing time.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Can one work in Canada with a Super Visa?

No, they can’t, as the super visa only provides a visitor status. So your parents or grandparents will not be able to work on super visa insurance. However, if they want, they can apply for a work permit as they will be eligible for that. But it will be first required to find a job in Canada depending on the type of work permit they qualify for. After this, their status will change to that of a temporary worker if their work permit application gets approved, and their Super Visa validity will expire after that.

Is it allowed to stay permanently in Canada with a Super Visa?

The answer to this is “No” again. Your parents can only stay in Canada till the validity of their Super Visa. Super Visa only offers a temporary residence.

Suppose you are considering inviting your parents or grandparents to stay with you permanently. In that case, you will have to make sure that you are eligible to sponsor their permanent residence as per the family sponsorship program. After getting permanent residence, your parents or grandparents can both work and stay in Canada permanently. However only a limited number of PRs are given under the family sponsorship program, and the application takes around two or more years to process. However, your parents or grandparents can continue living with you on a valid super visa during their PR application processing period.

Wrapping it Up

So if you are interested in applying for a Canadian Super Visa, you do not have to worry as the application approval rate is really high, and you will definitely achieve success in it. Canada ensures that you don’t have to be away from your loved ones and offers plenty of support options to bring your parents and grandparents to the country. It is advised to take the help of the best immigration professional, who will help you with the entire application process step by step.

Learn more: Benefits Of Using An Insurance Broker.

So find a good immigration professional today, as he will make the process a hundred times easier for you and ensure you qualify and succeed in the end.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com